The Buzz on Estate Planning Attorney

The Buzz on Estate Planning Attorney

Blog Article

Getting My Estate Planning Attorney To Work

Table of ContentsEstate Planning Attorney - An OverviewThings about Estate Planning AttorneyEstate Planning Attorney for DummiesWhat Does Estate Planning Attorney Mean?

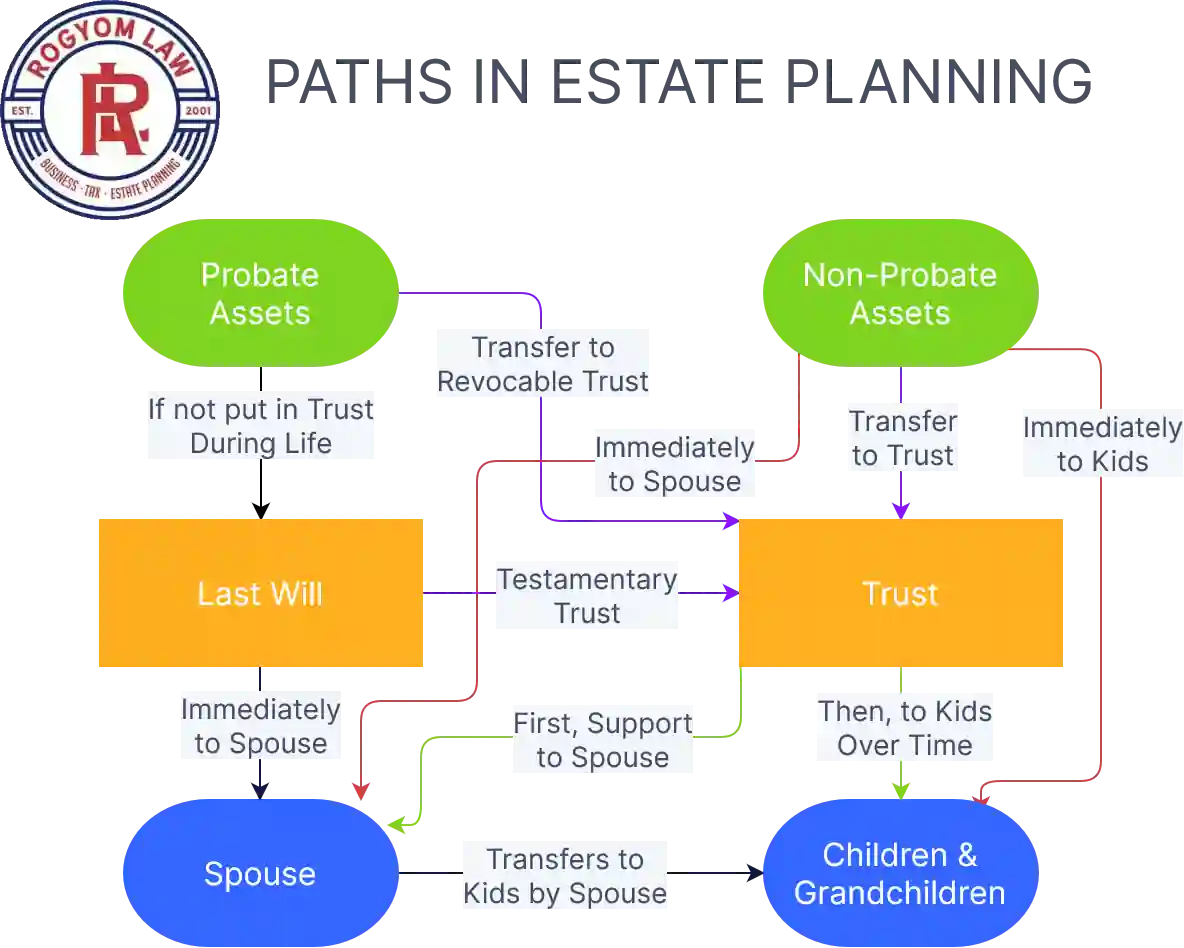

Estate planning is an activity strategy you can make use of to establish what occurs to your possessions and commitments while you're alive and after you die. A will, on the various other hand, is a lawful paper that describes how properties are distributed, that deals with kids and pet dogs, and any kind of other desires after you pass away.

Claims that are turned down by the executor can be taken to court where a probate judge will have the final say as to whether or not the insurance claim is legitimate.

The Only Guide to Estate Planning Attorney

After the supply of the estate has been taken, the worth of properties computed, and tax obligations and financial obligation settled, the administrator will then look for consent from the court to disperse whatever is left of the estate to the recipients. Any kind of estate tax obligations that are pending will come due within nine months of the day of fatality.

Each individual areas their properties in the trust fund and names a person various other than their spouse as the beneficiary., to sustain grandchildrens' education and learning.

The 2-Minute Rule for Estate Planning Attorney

This method entails freezing the value of a possession at its worth on the date of transfer. Appropriately, the quantity of potential funding gain at fatality is also frozen, permitting the estate organizer to estimate their prospective tax obligation go to this site liability upon death and much better prepare for the payment of income taxes.

If enough insurance earnings are offered and the plans are properly structured, any earnings tax on the considered personalities of properties following the death of an individual can be paid without turning to the sale of possessions. Profits from life insurance policy that are received by the beneficiaries upon the death of Click This Link the guaranteed are normally earnings tax-free.

There are particular papers you'll need as component of the estate preparation process. Some of the most common ones include wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a myth that estate preparation is only for high-net-worth people. Estate intending makes it much easier for individuals to establish their desires before and after they pass away.

Rumored Buzz on Estate Planning Attorney

You should start preparing for your estate as soon as you have any type of measurable possession base. It's an ongoing procedure: as life proceeds, your estate plan should move to match your conditions, in line with your brand-new goals. And maintain it. Refraining from doing your estate planning can cause unnecessary financial concerns to enjoyed ones.

Estate preparation is frequently believed of as a tool for the rich. Estate planning is also a terrific method for you to lay out strategies for the care of your minor children and animals and to describe your desires for your funeral and preferred charities.

Applications must be. Eligible candidates that pass the examination will be officially accredited in August. If you're eligible to rest for the exam from a previous application, you may file the brief application. According to the guidelines, no certification will last company website for a period much longer than 5 years. Learn when your recertification application schedules.

Report this page